Financial Accounts

Financial Ops

Integrations

Contact

Chat with our team to learn how Xoan simplifies real estate finance.

Give us a call at:

(855) 508-9626

Or email us:

hello@xoancapital.com

Short-term financing

Long-term financing

Property types

Contact

Chat with our team to learn how Xoan simplifies real estate finance.

Give us a call at:

(855) 508-9626

Or email us:

hello@xoancapital.com

Resources

Customer center

Contact

Chat with our team to learn how Xoan simplifies real estate finance.

Give us a call at:

(855) 508-9626

Or email us:

hello@xoancapital.com

Financial Accounts

Financial Ops

Integrations

Contact

Chat with our team to learn how Xoan simplifies real estate finance.

Give us a call at:

(855) 508-9626

Or email us:

hello@xoancapital.com

Short-term financing

Long-term financing

Property types

Contact

Chat with our team to learn how Xoan simplifies real estate finance.

Give us a call at:

(855) 508-9626

Or email us:

hello@xoancapital.com

Resources

Customer center

Contact

Chat with our team to learn how Xoan simplifies real estate finance.

Give us a call at:

(855) 508-9626

Or email us:

hello@xoancapital.com

Financial Accounts

Financial Ops

Integrations

Contact

Chat with our team to learn how Xoan simplifies real estate finance.

Give us a call at:

(855) 508-9626

Or email us:

hello@xoancapital.com

Short-term financing

Long-term financing

Property types

Contact

Chat with our team to learn how Xoan simplifies real estate finance.

Give us a call at:

(855) 508-9626

Or email us:

hello@xoancapital.com

Resources

Customer center

Contact

Chat with our team to learn how Xoan simplifies real estate finance.

Give us a call at:

(855) 508-9626

Or email us:

hello@xoancapital.com

Build wealth. One door at a time.

Build wealth. One door at a time.

Investor-focused DSCR loans based on rental income, not your W-2. Fast terms, clear guidelines, built for buy-and-hold and portfolio growth.

Investor-focused DSCR loans based on rental income, not your W-2. Fast terms, clear guidelines, built for buy-and-hold and portfolio growth.

Investor-focused DSCR loans based on rental income, not your W-2. Fast terms, clear guidelines, built for buy-and-hold and portfolio growth.

Rates Starting at

5.99%

"Xoan made the entire loan feel effortless. I tracked everything in one platform, uploaded docs once, and watched the loan move from start to funded in days. This is how real estate lending should work."

"Xoan made the entire loan feel effortless. I tracked everything in one platform, uploaded docs once, and watched the loan move from start to funded in days. This is how real estate lending should work."

"Xoan made the entire loan feel effortless. I tracked everything in one platform, uploaded docs once, and watched the loan move from start to funded in days. This is how real estate lending should work."

Harpreet Sing - Real estate investor

Harpreet Sing - Real estate investor

Harpreet Sing - Real estate investor

Harpreet Sing - Real estate investor

Financing built for the long game.

Financing built for the long game.

Whether you’re acquiring your first rental or refinancing a full portfolio, Xoan offers predictable funding and transparent terms to help you scale confidently. Every loan is built for investors who value speed, reliability, and flexibility.

Whether you’re acquiring your first rental or refinancing a full portfolio, Xoan offers predictable funding and transparent terms to help you scale confidently. Every loan is built for investors who value speed, reliability, and flexibility.

5.99%

5.99%

Rates starting at 5.99% depending on LTV, DSCR, and credit

Rates starting at 5.99% depending on LTV, DSCR, and credit

Rates starting at 5.99% depending on LTV, DSCR, and credit

$75K – $3M+

$75K – $3M+

Loan amount range available for single-property or portfolio DSCR loans

Loan amount range available for single-property or portfolio DSCR loans

Loan amount range available for single-property or portfolio DSCR loans

3/2/1 or None

3/2/1 or None

Flexible prepayment options to match your exit strategy

Flexible prepayment options to match your exit strategy

Flexible prepayment options to match your exit strategy

Nationwide

Nationwide

Coverage across most U.S. markets for 1–4 unit investment properties

Coverage across most U.S. markets for 1–4 unit investment properties

Coverage across most U.S. markets for 1–4 unit investment properties

80% LTV

80% LTV

Maximum loan-to-value (LTV) for purchase, refinance, and cash-out

Maximum loan-to-value (LTV) for purchase, refinance, and cash-out

Maximum loan-to-value (LTV) for purchase, refinance, and cash-out

5 days

5 days

Average closing time once appraisal and title are complete

Average closing time once appraisal and title are complete

Average closing time once appraisal and title are complete

0.75 DSCR

0.75 DSCR

Minimum qualifying Debt Service Coverage Ratio (DSCR)

Minimum qualifying Debt Service Coverage Ratio (DSCR)

Minimum qualifying Debt Service Coverage Ratio (DSCR)

0.25 DSCR

0.25 DSCR

Options available for strong credit or additional reserves.

Options available for strong credit or additional reserves.

Options available for strong credit or additional reserves.

We’ve modernized the application process

Because we already understand your entity and profile, you can get terms on a new deal in less tha a minute. Enter a few deal-specific inputs and receive terms that you can close with.

Get Started

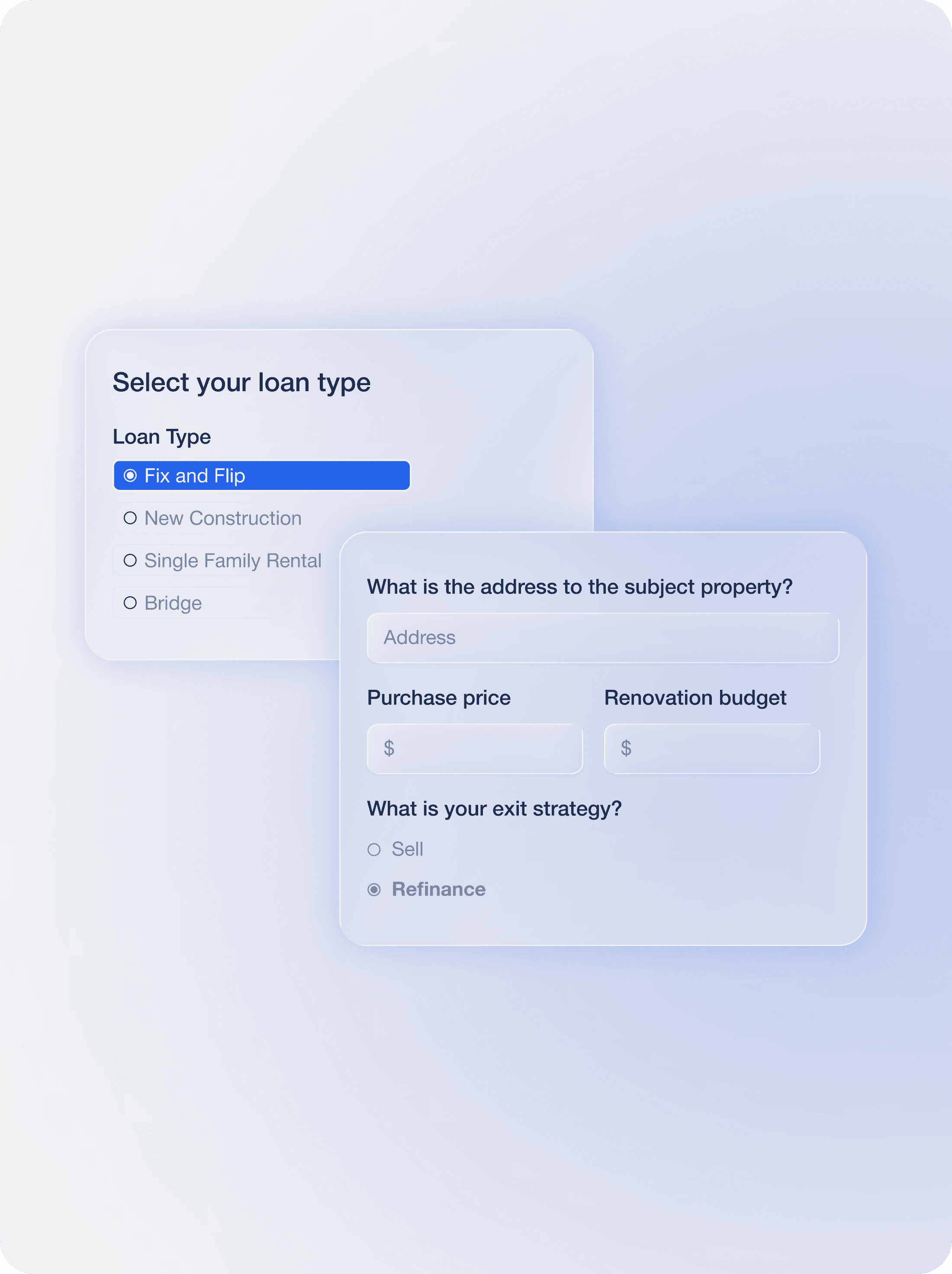

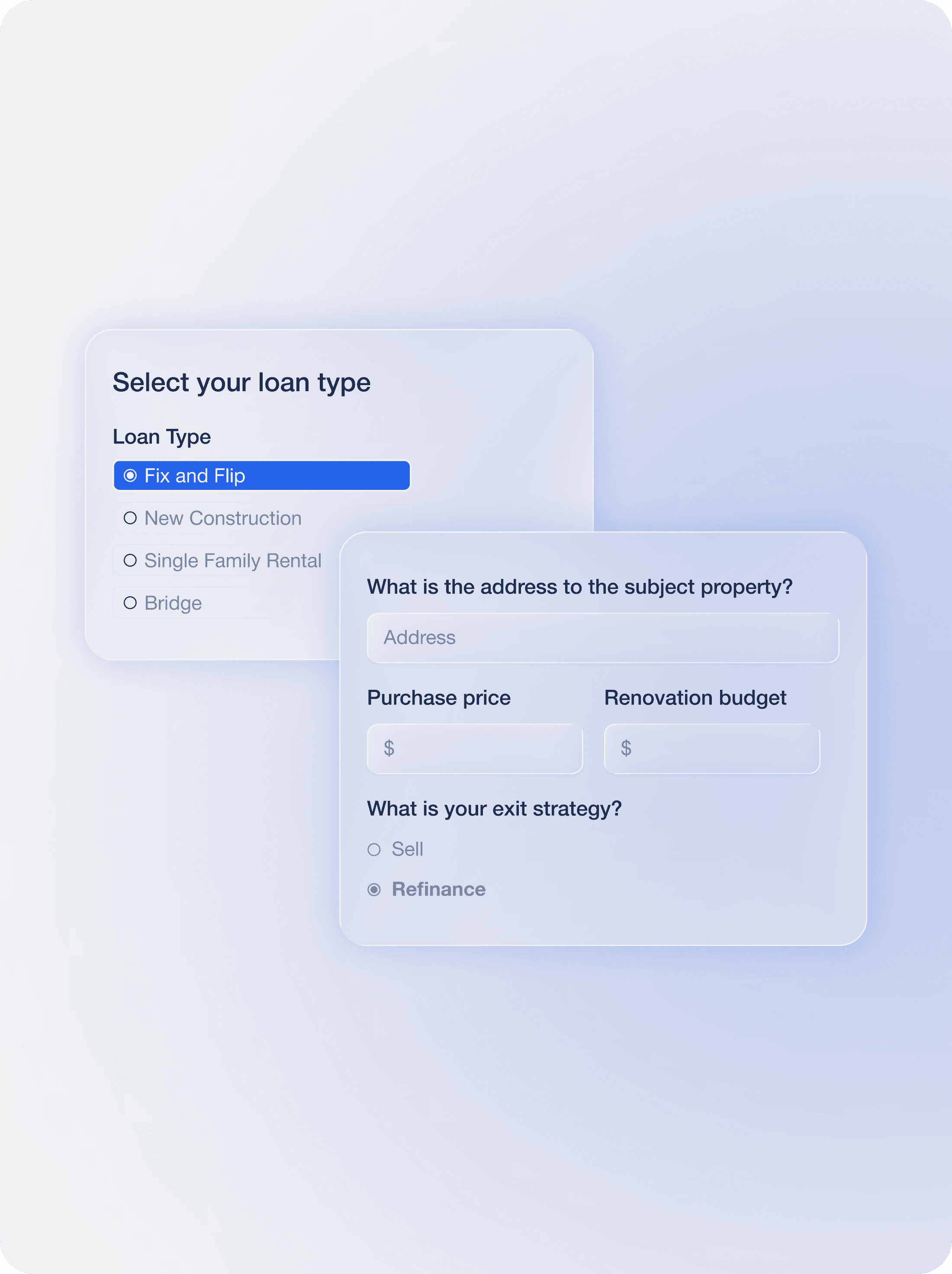

Step 1: Tell us about your deal

We only need a few data points in order to provide you pricing.

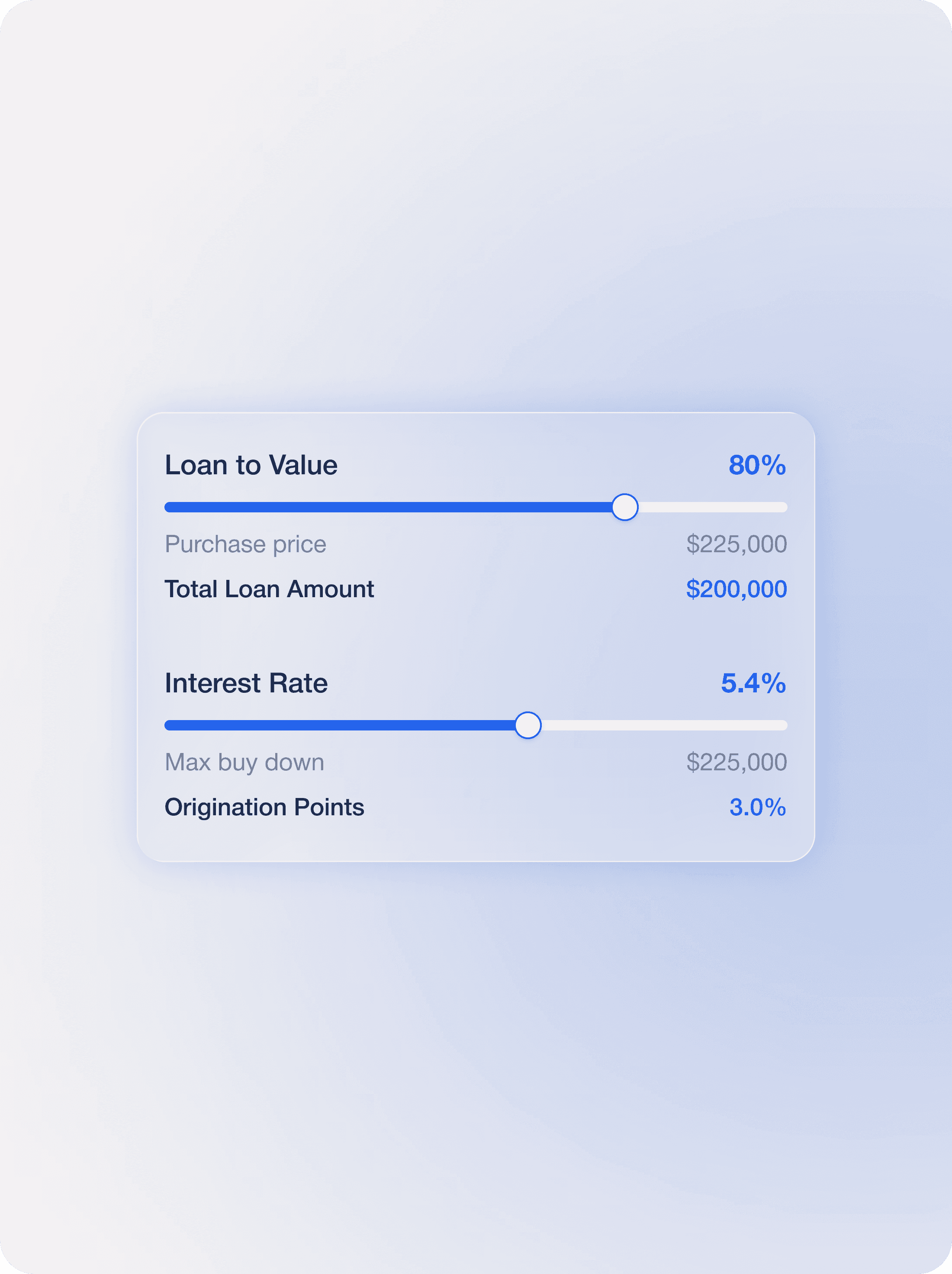

Step 2: Customize your loan

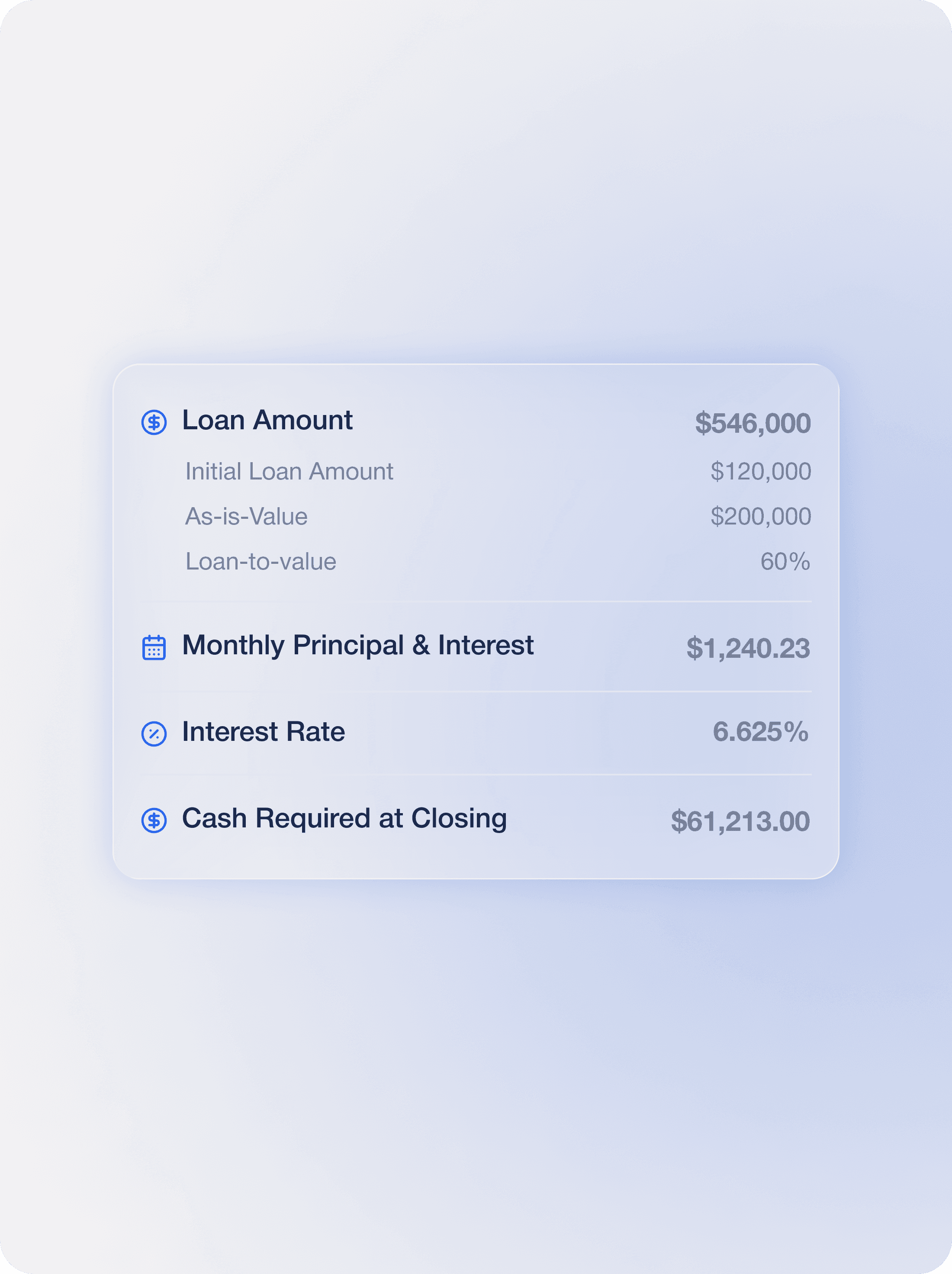

Step 3: Get instant terms

We’ve modernized the application process

Because we already understand your entity and profile, you can get terms on a new deal in less tha a minute. Enter a few deal-specific inputs and receive terms that you can close with.

Get Started

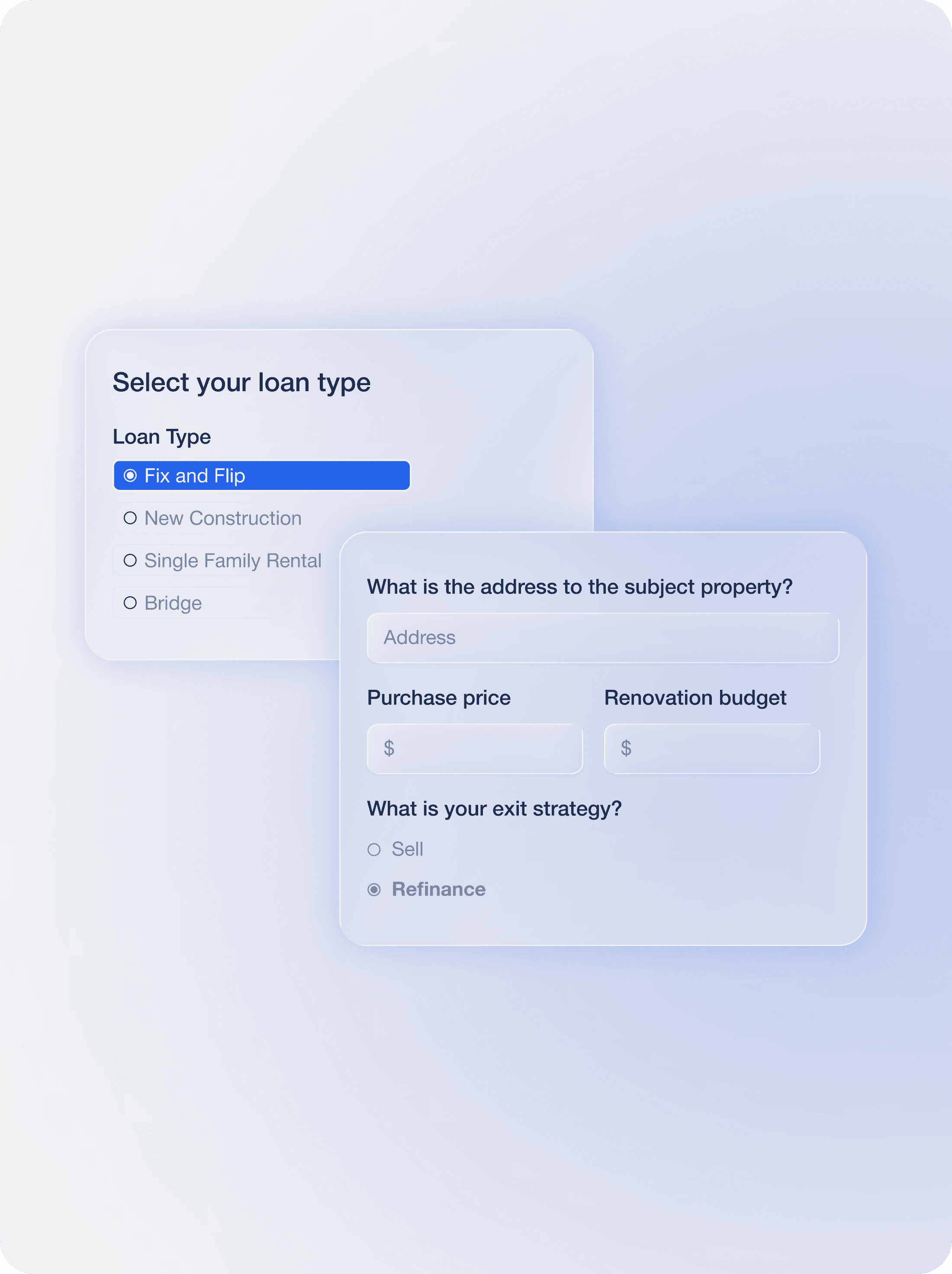

Step 1: Tell us about your deal

We only need a few data points in order to provide you pricing.

Step 2: Customize your loan

Step 3: Get instant terms

We’ve modernized the application process

Because we already understand your entity and profile, you can get terms on a new deal in less tha a minute. Enter a few deal-specific inputs and receive terms that you can close with.

Get Started

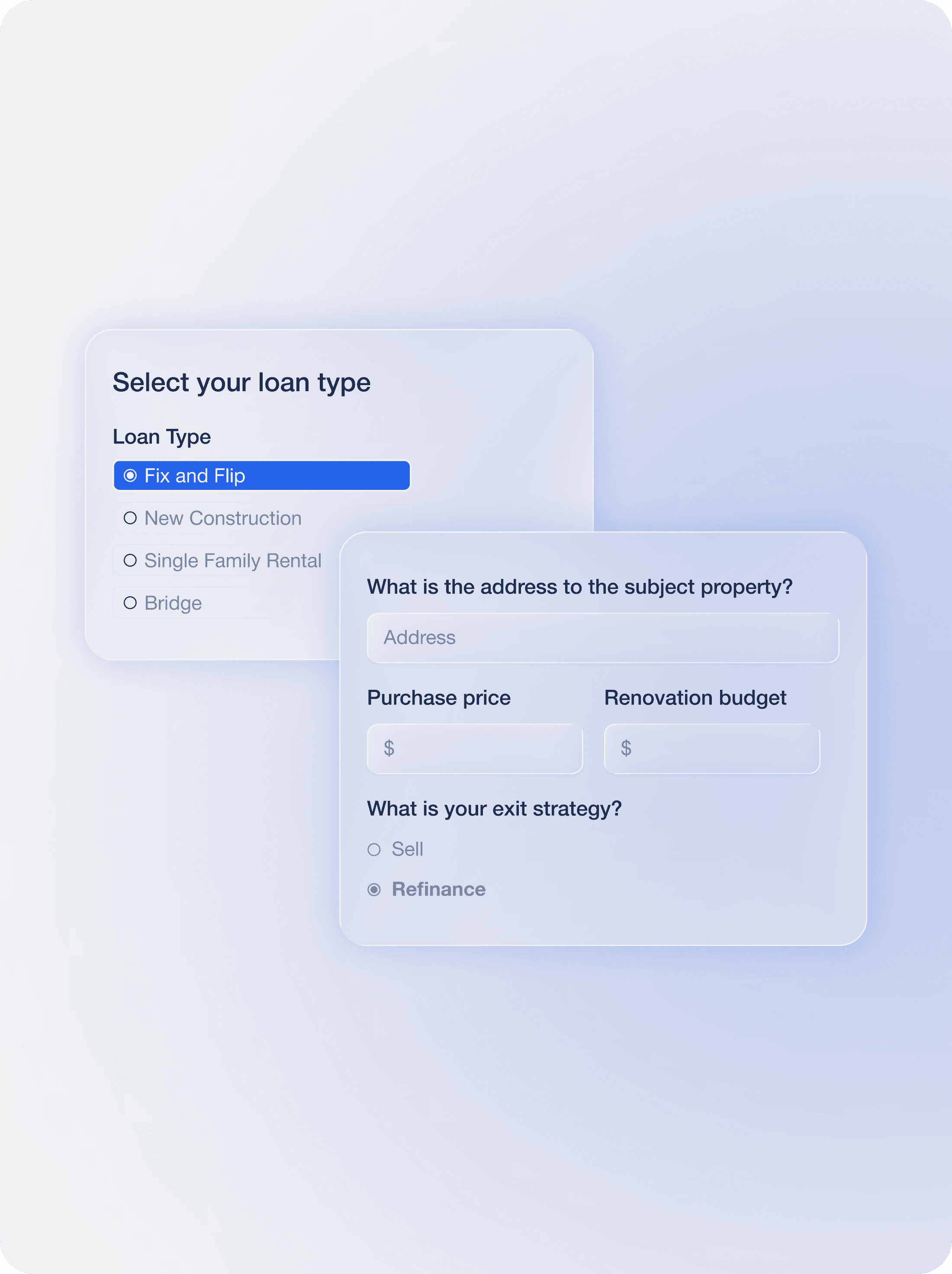

Step 1: Tell us about your deal

We only need a few data points in order to provide you pricing.

Step 2: Customize your loan

Step 3: Get instant terms

We’ve modernized the application process

Because we already understand your entity and profile, you can get terms on a new deal in less tha a minute. Enter a few deal-specific inputs and receive terms that you can close with.

Get Started

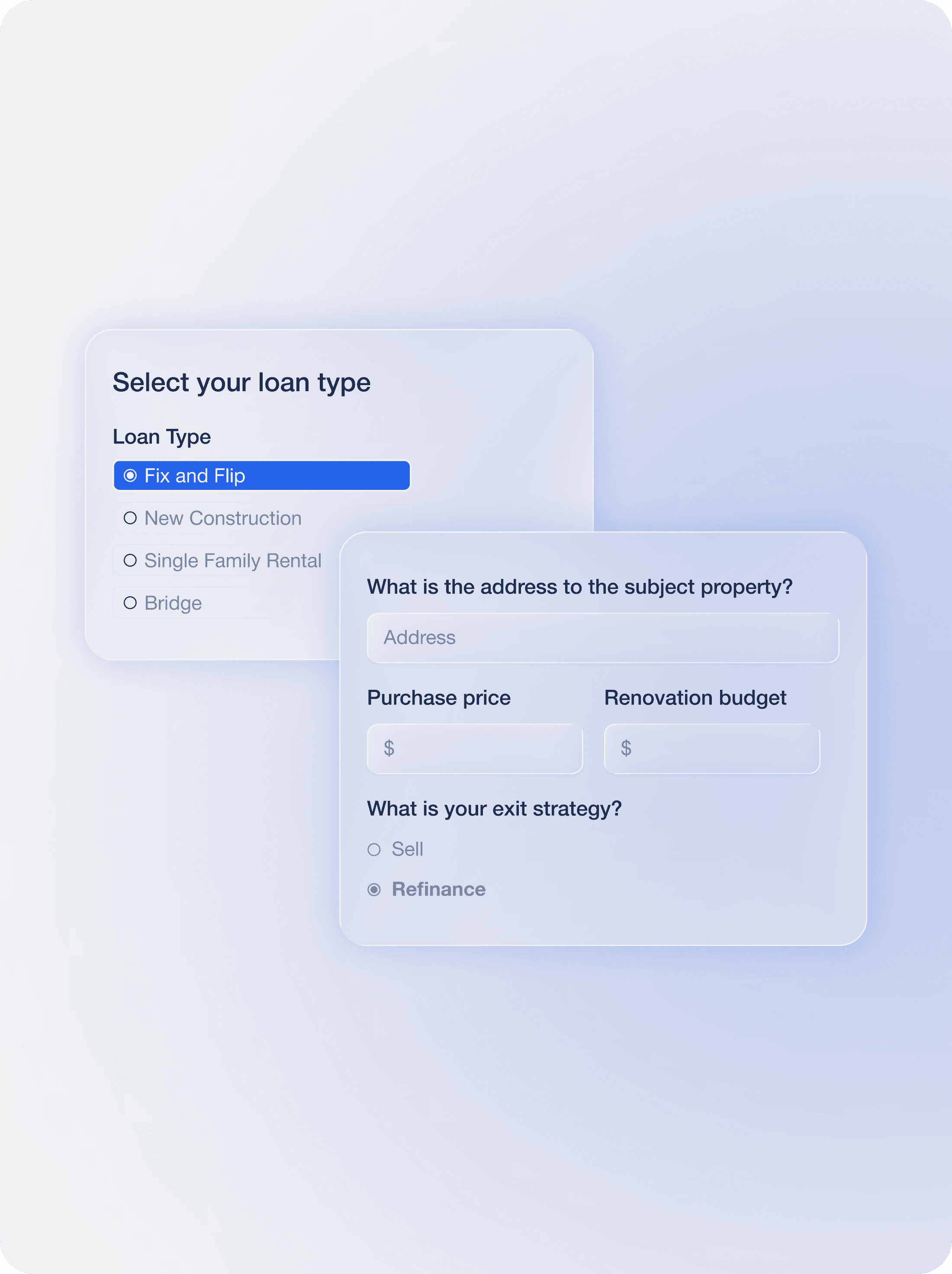

Step 1: Tell us about your deal

We only need a few data points in order to provide you pricing.

Step 2: Customize your loan

Step 3: Get instant terms

We’ve modernized the application process

After you sign up to use the Xoan platform, we already understand your entity and profile, you can get terms on a new deal in less than a minute. Enter a few deal-specific inputs and receive terms that you can close with.

Get Started

Step 1: Tell us about your deal

We only need a few data points in order to provide you pricing.

Step 2: Customize your loan

Step 3: Get instant terms

A clear path for new and growing investors

Xoan’s tiered lending model adapts to your experience. New investors get a clear, supportive path to start flipping with confidence. Experienced operators unlock faster closings, no appraisal requirements, and industry-leading pricing. It is the first fix and flip loan designed to scale with you.

A strong starting point for newer investors

Xoan gives new and growing investors simple approvals, clear requirements, and competitive leverage. Each completed project improves your tier, unlocking faster closings and better pricing as you build experience.

Xoan gives new and growing investors simple approvals, clear requirements, and competitive leverage. Each completed project improves your tier, unlocking faster closings and better pricing as you build experience.

Get started

Get started

Get started

Get started

Get started

Speed and pricing built for experts

Prime member investors get closings in 48 to 72 hours, no appraisal requirements for fix and flip, and our most competitive rates. Your experience is rewarded with the fastest, most efficient capital we offer.

Prime member investors get closings in 48 to 72 hours, no appraisal requirements for fix and flip, and our most competitive rates. Your experience is rewarded with the fastest, most efficient capital we offer.

Get premier speed

Get premier speed

Get premier speed

Get premier speed

Get premier speed

Control your money. Achieve financial freedom. Open a business account today.

Control your money. Achieve financial freedom.

Open a business account today.

Control your money. Achieve financial freedom.

Open a business account today.

Control your money. Achieve financial freedom. Open a business account today.

Control your money and move closer to financial freedom.

See other loan types we offer

Explore our financing solutions for every investment strategy.

See other loan types we offer

Explore our financing solutions for every investment strategy.

See other loan types we offer

Explore our financing solutions for every investment strategy.

See other loan types we offer

Explore our financing solutions for every investment strategy.

See other loan types we offer

Explore our financing solutions for every investment strategy.

Have Questions?

Have Questions?

Have Questions?

FAQs

FAQs

Everything you need to know about DSCR Rental Property loans with Xoan.

Everything you need to know about DSCR Rental Property loans with Xoan.

Everything you need to know about DSCR Rental Property loans with Xoan.

Everything you need to know about DSCR Rental Property loans with Xoan.

What types of properties qualify for a DSCR rental loan?

DSCR rental loans apply to 1–4 unit residential investment properties, including single-family homes, condos, townhomes, duplexes, triplexes, and four-plexes. All properties must be non-owner-occupied and strictly for business-purpose use.

What types of properties qualify for a DSCR rental loan?

DSCR rental loans apply to 1–4 unit residential investment properties, including single-family homes, condos, townhomes, duplexes, triplexes, and four-plexes. All properties must be non-owner-occupied and strictly for business-purpose use.

What types of properties qualify for a DSCR rental loan?

DSCR rental loans apply to 1–4 unit residential investment properties, including single-family homes, condos, townhomes, duplexes, triplexes, and four-plexes. All properties must be non-owner-occupied and strictly for business-purpose use.

What types of properties qualify for a DSCR rental loan?

DSCR rental loans apply to 1–4 unit residential investment properties, including single-family homes, condos, townhomes, duplexes, triplexes, and four-plexes. All properties must be non-owner-occupied and strictly for business-purpose use.

What types of properties qualify for a DSCR rental loan?

DSCR rental loans apply to 1–4 unit residential investment properties, including single-family homes, condos, townhomes, duplexes, triplexes, and four-plexes. All properties must be non-owner-occupied and strictly for business-purpose use.

Who is eligible to borrow?

Who is eligible to borrow?

Who is eligible to borrow?

Who is eligible to borrow?

Who is eligible to borrow?

What credit score is required?

What credit score is required?

What credit score is required?

What credit score is required?

What credit score is required?

What does DSCR mean?

What does DSCR mean?

What does DSCR mean?

What does DSCR mean?

What does DSCR mean?

What DSCR is required to qualify?

What DSCR is required to qualify?

What DSCR is required to qualify?

What DSCR is required to qualify?

What DSCR is required to qualify?

How does DSCR affect pricing and reserves?

How does DSCR affect pricing and reserves?

How does DSCR affect pricing and reserves?

How does DSCR affect pricing and reserves?

How does DSCR affect pricing and reserves?

What are the reserve requirements?

What are the reserve requirements?

What are the reserve requirements?

What are the reserve requirements?

What are the reserve requirements?

Are income or employment documents required?

Are income or employment documents required?

Are income or employment documents required?

Are income or employment documents required?

Are income or employment documents required?

What appraisal documents are required?

What appraisal documents are required?

What appraisal documents are required?

What appraisal documents are required?

What appraisal documents are required?

Are short-term rentals (STRs) eligible?

Are short-term rentals (STRs) eligible?

Are short-term rentals (STRs) eligible?

Are short-term rentals (STRs) eligible?

Are short-term rentals (STRs) eligible?

Still have questions?

Still have questions?

Have questions or need assistance? Our team is here to help!

Have questions or need assistance? Our team is here to help!

Contact us

Address:

One Sansome Street Suite 1400

San Francisco, CA 94104

Contact:

hello@xoancapital.com

(855) 508-9626

Disclaimers and footnotes

Xoan Technology Inc. partners with Stripe Payments Company for money transmission services and account services with funds held at Fifth Third Bank, N.A., Member FDIC. Xoan Mastercard® Business Cards are issued by Celtic Bank, Member FDIC.

Xoan Business Accounts are eligible for FDIC pass-through deposit insurance if they meet certain requirements. The accounts are eligible only to the extent passthrough insurance is permitted by the rules and regulations of the FDIC, and if the requirements for pass-through insurance are satisfied. The FDIC insurance applies up to 250,000 USD per depositor, per financial institution, for deposits held in the same ownership capacity.

Xoan Mastercard® Business Cards are powered by Stripe and issued by Celtic Bank, Member FDIC, pursuant to a license from Mastercard®. Eligible customers may receive access to Xoan Mastercard® Business Cards upon approval of a Xoan business account, subject to eligibility requirements and limitations.

Cashback rewards are credited to the associated Xoan financial account in accordance with the applicable program terms. Accounts must be open and in good standing to earn or receive cashback. Cashback is only earned on eligible transactions made at merchants classified under specific merchant category codes (MCCs) related to contractor and construction-related spend. Transactions processed under non-eligible MCCs do not qualify for cashback, even if the merchant provides contractor or construction services. Cashback rates, rewards, eligible transactions, and eligibility criteria are subject to change at any time without notice. Cashback rewards may be adjusted, withheld, reversed, or forfeited if an account is closed, pending closure, or determined to be in violation of applicable terms, policies, or legal requirements. Xoan reserves the right to modify, suspend, or terminate the cashback program at any time. Any material changes or promotional offers will be communicated via email or posted on the Xoan website. Full cashback program terms and conditions are available at Cashback Rewards Terms. For questions regarding cashback or card usage, please contact support@xoancapital.com

High Yield Accounts involve investment risk, including the possible loss of principal. When a user allocates funds to a High Yield Account, the user is purchasing debt securities issued by Xoan Capital LLC. Xoan Capital LLC is a subsidiary of Xoan Technology, Inc. Funds allocated to High Yield Accounts are not deposits, are not bank accounts, and are not insured by the FDIC or any other government agency.

Any stated yield represents a target annual rate, is not guaranteed. Actual returns may be lower or higher than any stated target and may be zero or negative. Returns are derived from the performance of loans originated or acquired by Xoan Capital LLC. These loans are subject to credit risk, borrower default, collateral value fluctuations, interest rate risk, liquidity risk, valuation risk, and other market, operational, and regulatory risks.

Interest is earned only while funds remain invested in eligible High Yield Accounts and is subject to applicable terms, conditions, eligibility requirements, and liquidity restrictions, including any applicable lock-up periods, notice requirements, or redemption limitations. Requests to transfer or withdraw funds from a High Yield Account constitute a request to redeem the associated debt securities. Redemptions are not guaranteed and may be delayed, limited, suspended, or processed at an amount that is less than the original investment, including a loss of principal.

Past performance is not indicative of future results. Detailed information regarding Xoan Capital LLC, including material risks, fees, liquidity terms, and redemption mechanics, is provided in the applicable private placement memorandum, which is available to eligible users through the Xoan platform. Prospective investors should carefully review all offering materials and consider their financial situation, investment objectives, and risk tolerance before allocating funds.

All loan and credit products are subject to underwriting, credit approval, collateral review, and other eligibility requirements, as well as product availability. Any information provided on this website is for general informational purposes only and does not constitute an offer, commitment, approval, or obligation to lend. Loan terms, rates, amounts, and availability are subject to change and may be modified, withdrawn, or terminated at any time without notice. Credit decisions are based on a variety of factors, which may include borrower creditworthiness, financial condition, property characteristics, loan structure, market conditions, and compliance with applicable legal and regulatory requirements. Not all applicants will qualify, and approval of one product or transaction does not guarantee approval of future credit.

Xoan Capital LLC, a subsidiary of Xoan Technology Inc., may act as a lender, broker, servicer, or facilitator, depending on the product, structure, jurisdiction, and transaction. Certain loans may be originated by or funded through third-party lenders or investors, and loan terms may vary accordingly. Fees, costs, and other charges may apply, including origination fees, interest, servicing fees, and third-party costs, as disclosed in applicable loan documents. Estimated rates, timelines, proceeds, and terms are illustrative only and may not reflect actual loan terms. Closing timelines are not guaranteed and may vary based on diligence, documentation, title, appraisal, borrower responsiveness, and third-party processes. Xoan Capital LLC reserves the right to change rates, terms, eligibility criteria, underwriting standards, and program guidelines at its sole discretion.

By accessing, applying for, or engaging with any Xoan lending product or related services, users acknowledge that they have reviewed and understand these disclosures. These disclosures are provided for informational purposes only, binding terms and conditions are set forth solely in the applicable loan agreements and related legal documents.

Copyright © 2026 xoancapital.com. All rights reserved.

Address:

One Sansome Street Suite 1400

San Francisco, CA 94104

Contact:

hello@xoancapital.com

(855) 508-9626

Disclaimers and footnotes

Xoan Technology Inc. partners with Stripe Payments Company for money transmission services and account services with funds held at Fifth Third Bank, N.A., Member FDIC. Xoan Mastercard® Business Cards are issued by Celtic Bank, Member FDIC.

Xoan Business Accounts are eligible for FDIC pass-through deposit insurance if they meet certain requirements. The accounts are eligible only to the extent passthrough insurance is permitted by the rules and regulations of the FDIC, and if the requirements for pass-through insurance are satisfied. The FDIC insurance applies up to 250,000 USD per depositor, per financial institution, for deposits held in the same ownership capacity.

Xoan Mastercard® Business Cards are powered by Stripe and issued by Celtic Bank, Member FDIC, pursuant to a license from Mastercard®. Eligible customers may receive access to Xoan Mastercard® Business Cards upon approval of a Xoan business account, subject to eligibility requirements and limitations.

Cashback rewards are credited to the associated Xoan financial account in accordance with the applicable program terms. Accounts must be open and in good standing to earn or receive cashback. Cashback is only earned on eligible transactions made at merchants classified under specific merchant category codes (MCCs) related to contractor and construction-related spend. Transactions processed under non-eligible MCCs do not qualify for cashback, even if the merchant provides contractor or construction services. Cashback rates, rewards, eligible transactions, and eligibility criteria are subject to change at any time without notice. Cashback rewards may be adjusted, withheld, reversed, or forfeited if an account is closed, pending closure, or determined to be in violation of applicable terms, policies, or legal requirements. Xoan reserves the right to modify, suspend, or terminate the cashback program at any time. Any material changes or promotional offers will be communicated via email or posted on the Xoan website. Full cashback program terms and conditions are available at Cashback Rewards Terms. For questions regarding cashback or card usage, please contact support@xoancapital.com

High Yield Accounts involve investment risk, including the possible loss of principal. When a user allocates funds to a High Yield Account, the user is purchasing debt securities issued by Xoan Capital LLC. Xoan Capital LLC is a subsidiary of Xoan Technology, Inc. Funds allocated to High Yield Accounts are not deposits, are not bank accounts, and are not insured by the FDIC or any other government agency.

Any stated yield represents a target annual rate, is not guaranteed. Actual returns may be lower or higher than any stated target and may be zero or negative. Returns are derived from the performance of loans originated or acquired by Xoan Capital LLC. These loans are subject to credit risk, borrower default, collateral value fluctuations, interest rate risk, liquidity risk, valuation risk, and other market, operational, and regulatory risks.

Interest is earned only while funds remain invested in eligible High Yield Accounts and is subject to applicable terms, conditions, eligibility requirements, and liquidity restrictions, including any applicable lock-up periods, notice requirements, or redemption limitations. Requests to transfer or withdraw funds from a High Yield Account constitute a request to redeem the associated debt securities. Redemptions are not guaranteed and may be delayed, limited, suspended, or processed at an amount that is less than the original investment, including a loss of principal.

Past performance is not indicative of future results. Detailed information regarding Xoan Capital LLC, including material risks, fees, liquidity terms, and redemption mechanics, is provided in the applicable private placement memorandum, which is available to eligible users through the Xoan platform. Prospective investors should carefully review all offering materials and consider their financial situation, investment objectives, and risk tolerance before allocating funds.

All loan and credit products are subject to underwriting, credit approval, collateral review, and other eligibility requirements, as well as product availability. Any information provided on this website is for general informational purposes only and does not constitute an offer, commitment, approval, or obligation to lend. Loan terms, rates, amounts, and availability are subject to change and may be modified, withdrawn, or terminated at any time without notice. Credit decisions are based on a variety of factors, which may include borrower creditworthiness, financial condition, property characteristics, loan structure, market conditions, and compliance with applicable legal and regulatory requirements. Not all applicants will qualify, and approval of one product or transaction does not guarantee approval of future credit.

Xoan Capital LLC, a subsidiary of Xoan Technology Inc., may act as a lender, broker, servicer, or facilitator, depending on the product, structure, jurisdiction, and transaction. Certain loans may be originated by or funded through third-party lenders or investors, and loan terms may vary accordingly. Fees, costs, and other charges may apply, including origination fees, interest, servicing fees, and third-party costs, as disclosed in applicable loan documents. Estimated rates, timelines, proceeds, and terms are illustrative only and may not reflect actual loan terms. Closing timelines are not guaranteed and may vary based on diligence, documentation, title, appraisal, borrower responsiveness, and third-party processes. Xoan Capital LLC reserves the right to change rates, terms, eligibility criteria, underwriting standards, and program guidelines at its sole discretion.

By accessing, applying for, or engaging with any Xoan lending product or related services, users acknowledge that they have reviewed and understand these disclosures. These disclosures are provided for informational purposes only, binding terms and conditions are set forth solely in the applicable loan agreements and related legal documents.

Copyright © 2026 xoancapital.com. All rights reserved.

Address:

One Sansome Street Suite 1400

San Francisco, CA 94104

Contact:

hello@xoancapital.com

(855) 508-9626

Disclaimers and footnotes

Xoan Technology Inc. partners with Stripe Payments Company for money transmission services and account services with funds held at Fifth Third Bank, N.A., Member FDIC. Xoan Mastercard® Business Cards are issued by Celtic Bank, Member FDIC.

Xoan Business Accounts are eligible for FDIC pass-through deposit insurance if they meet certain requirements. The accounts are eligible only to the extent passthrough insurance is permitted by the rules and regulations of the FDIC, and if the requirements for pass-through insurance are satisfied. The FDIC insurance applies up to 250,000 USD per depositor, per financial institution, for deposits held in the same ownership capacity.

Xoan Mastercard® Business Cards are powered by Stripe and issued by Celtic Bank, Member FDIC, pursuant to a license from Mastercard®. Eligible customers may receive access to Xoan Mastercard® Business Cards upon approval of a Xoan business account, subject to eligibility requirements and limitations.

Cashback rewards are credited to the associated Xoan financial account in accordance with the applicable program terms. Accounts must be open and in good standing to earn or receive cashback. Cashback is only earned on eligible transactions made at merchants classified under specific merchant category codes (MCCs) related to contractor and construction-related spend. Transactions processed under non-eligible MCCs do not qualify for cashback, even if the merchant provides contractor or construction services. Cashback rates, rewards, eligible transactions, and eligibility criteria are subject to change at any time without notice. Cashback rewards may be adjusted, withheld, reversed, or forfeited if an account is closed, pending closure, or determined to be in violation of applicable terms, policies, or legal requirements. Xoan reserves the right to modify, suspend, or terminate the cashback program at any time. Any material changes or promotional offers will be communicated via email or posted on the Xoan website. Full cashback program terms and conditions are available at Cashback Rewards Terms. For questions regarding cashback or card usage, please contact support@xoancapital.com

High Yield Accounts involve investment risk, including the possible loss of principal. When a user allocates funds to a High Yield Account, the user is purchasing debt securities issued by Xoan Capital LLC. Xoan Capital LLC is a subsidiary of Xoan Technology, Inc. Funds allocated to High Yield Accounts are not deposits, are not bank accounts, and are not insured by the FDIC or any other government agency.

Any stated yield represents a target annual rate, is not guaranteed. Actual returns may be lower or higher than any stated target and may be zero or negative. Returns are derived from the performance of loans originated or acquired by Xoan Capital LLC. These loans are subject to credit risk, borrower default, collateral value fluctuations, interest rate risk, liquidity risk, valuation risk, and other market, operational, and regulatory risks.

Interest is earned only while funds remain invested in eligible High Yield Accounts and is subject to applicable terms, conditions, eligibility requirements, and liquidity restrictions, including any applicable lock-up periods, notice requirements, or redemption limitations. Requests to transfer or withdraw funds from a High Yield Account constitute a request to redeem the associated debt securities. Redemptions are not guaranteed and may be delayed, limited, suspended, or processed at an amount that is less than the original investment, including a loss of principal.

Past performance is not indicative of future results. Detailed information regarding Xoan Capital LLC, including material risks, fees, liquidity terms, and redemption mechanics, is provided in the applicable private placement memorandum, which is available to eligible users through the Xoan platform. Prospective investors should carefully review all offering materials and consider their financial situation, investment objectives, and risk tolerance before allocating funds.

All loan and credit products are subject to underwriting, credit approval, collateral review, and other eligibility requirements, as well as product availability. Any information provided on this website is for general informational purposes only and does not constitute an offer, commitment, approval, or obligation to lend. Loan terms, rates, amounts, and availability are subject to change and may be modified, withdrawn, or terminated at any time without notice. Credit decisions are based on a variety of factors, which may include borrower creditworthiness, financial condition, property characteristics, loan structure, market conditions, and compliance with applicable legal and regulatory requirements. Not all applicants will qualify, and approval of one product or transaction does not guarantee approval of future credit.

Xoan Capital LLC, a subsidiary of Xoan Technology Inc., may act as a lender, broker, servicer, or facilitator, depending on the product, structure, jurisdiction, and transaction. Certain loans may be originated by or funded through third-party lenders or investors, and loan terms may vary accordingly. Fees, costs, and other charges may apply, including origination fees, interest, servicing fees, and third-party costs, as disclosed in applicable loan documents. Estimated rates, timelines, proceeds, and terms are illustrative only and may not reflect actual loan terms. Closing timelines are not guaranteed and may vary based on diligence, documentation, title, appraisal, borrower responsiveness, and third-party processes. Xoan Capital LLC reserves the right to change rates, terms, eligibility criteria, underwriting standards, and program guidelines at its sole discretion.

By accessing, applying for, or engaging with any Xoan lending product or related services, users acknowledge that they have reviewed and understand these disclosures. These disclosures are provided for informational purposes only, binding terms and conditions are set forth solely in the applicable loan agreements and related legal documents.

Copyright © 2026 xoancapital.com. All rights reserved.